How to conquer your personal debts

If you’re weighed down by a tonne of consumer debt, subscriptions and services that you haven’t reviewed in a while, then conquering it should be your top priority. Thanks to the magic of compound interest, the longer you leave your debt, the bigger and faster it grows – so it’s something you really need to get on top of, yesterday.

This is a process I went through over the Christmas break, and I was astounded at how much money I’ve saved. I sat with a spreadsheet for a few hours and raked through every single outgoing, direct debit and subscription in my personal and business budget.I thencalled all of the service providers and asked them to review my packages (which I hadn’t done in years!)or requested price matches to others who could give me a better deal.

There were subscriptions on direct debit taking out $10 here, $12 there, payments for Foxtel and Netflix, accounts with both Apple Music and Spotify (I don’t need both!) After all was said and done, I had injected approximately $600/m per month back into my bottom line. That’s more than $7,000 for the year – not bad, for half a day’s work!

The start of the year is a really great time to go through this process and get “cashflow rich”, so I urge you to do this. The first step is to go through your budget and get the best prices from all of your providers, as outlined above. The next step is to tackle the debts that you have left – I’m talking credit cards, store cards, personal loans and car finance.

American personal finance guru Dave Ramsey once coined the term “snowball method” for his approach to paying off debts, and it’s as simple as it is genius. According to Ramsey, this method helps to keep you motivated, which is key to tackling your debts for good.

Instead of paying off the debt with the highest interest rate first, Ramsey suggests that you start by wiping out the smallest debt, because this gives you the momentum you need to conquer all your bills.

Using this method, you essentially continue to make the minimum repayments on all your debts, but you throw any spare cash you have towards the smallest debt.

Once that is paid off, you direct any extra cash to the next smallest debt, and so-on, until you’re debt free.

It’s like a snowball rolling downhill – it starts off small, picks up extra snow along the way, and before you know it you’ve reached the bottom of the mountain and your snowball (aka the amount of debt you’ve paid off) is huge!

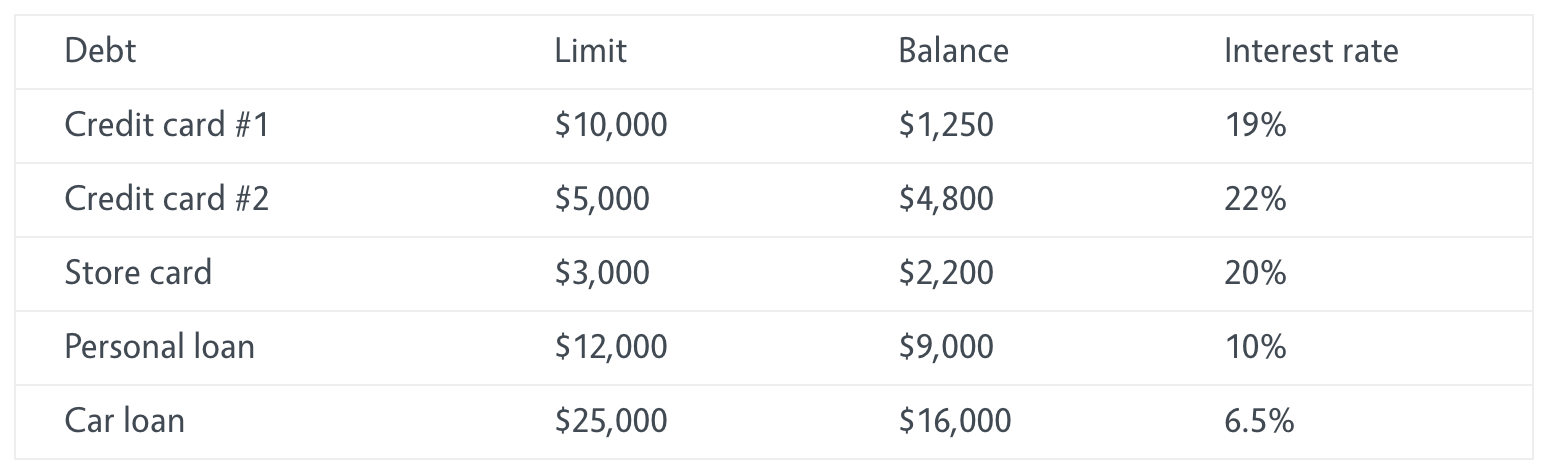

Here’s how it works in practice: let’s say you have 5 debts:

From a purely financial perspective, it may make sense to attack the highest interest debts first and foremost – in this case that would be credit card #2, with a 22% interest rate.

But using the Snowball method of conquering your debt, you attack the smallest debt first (credit card #1, with a balance of $1,250).

Every month, you would pay the minimum required on all debts except for credit card no.1, which you should aim to pay off as soon as possible. Once the balance is down to zero, the card should be cancelled – and then you can work on repaying the next debt, which is the store card with a $2,000 balance.

Importantly, you must not spend anything extra on these cards while you’re trying to pay them off, or it defeats the purpose altogether!

It may also help if you can reduce your credit limit as you repay debt, to ensure you’re not tempted to spend.

Another great way to get on top of your debts is to take advantage of consolidating your debts into a personal loan, with one easy-to-manage monthly payment. Moving your existing credit card debts to a personal loan with a low interest rate could save you thousands of dollars, as you’re effectively swapping out an interest rate of 20% plus for 8-10%.

To make it work, it goes without saying that you must cancel the original cards, to avoid racking up expenses on those cards and effectively doubling your debt. You’ll also need to do a few quick calculations certain it’s a cost-effective way of paying down your debt. Many people don’t realise that as well as arranging home loans, at Classic Finance we can also help you with personal loans to factor in any transfer fees, application fees or annual fees that may apply, so you’re and car finance – so if you’d like us to crunch the numbers for you, contact us today.